To translate a page just copy what is in the page click on Google Translate and choose translate from English and then your language. When you click on Google Translate it will open up another web page for you .

This page is for open daily discussions such as Private Placement Programs, Project Funding, Financial News, Global Banking, Wealth Building, Personal Security, Hardened Structures etc. Feel free to register and communicate openly on the topics that are most important to you.

Thank you,

Jeffery Thomas J L Thomas Consulting

5/24/2014

Daily Discussions 2

Wealth Building through PPP with Project Creation

In this discussion I will be discussing how to capture personal profits from PPP through project creation. The client can capture up to 20% of trade in most cases but the other 80% is committed to a humanitarian project in form or another. (These are estimated numbers but typical)

This discussion is geared towards those who have the financial means but does not have any large scale projects in place or does not want to.

We all have understanding of what humanitarian means and stands for but just clarity.

hu·man·i·tar·i·an [hyoo-man-i-tair-ee-uhn or, often, yoo-] Show IPA adjective

1. Having concern for or helping to improve the welfare and happiness of people.

2. Of or pertaining to ethical or theological humanitarianism.

3. Pertaining to the saving of human lives or to the alleviation of suffering: a humanitarian crisis. noun

4. A person actively engaged in promoting human welfare and social reforms, as a philanthropist.

5. A person who professes ethical or theological humanitarianism.

Anyhow, the general definition in the PPP world is to create jobs and stimulate manufacturing. But there are many options for you to donate where it matters most.

I myself have over the past thirty five years have had five start-ups and two buy-outs, some successful some not. I am tiered. I am tiered of the fraudulent taxation the cost of operation and the predictable and consistent failure of employee’s. Let a loan theft.

Here is a distilled outline of my intentions and what is already in play. In short I am giving the money away! I have an almost unlimited approved list of portals to donate while generating huge tax breaks. Keep in mind it will be a legal and logistical challenge putting mildly, but it will be worth it in the end, especially when it comes to setting up your family’s financial future.

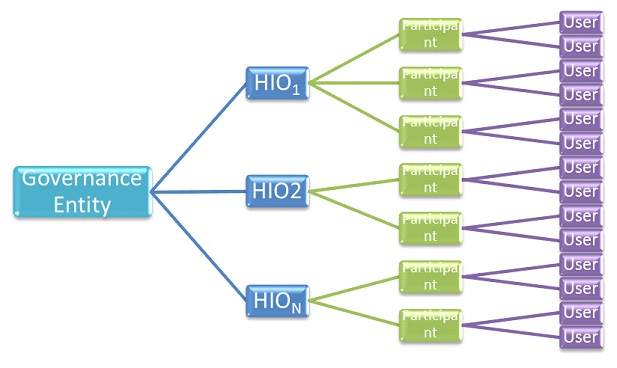

I started off creating a list the top five topics that are most important to me and then down streamed from there. Let me give you a horizontal hub and spoke diagram.

Taken from Google Images

After creating your list of what is important to you, sit down with an international trust attorney to start developing what is the best overall strategy for you. I recommendation would be James Campbell Stevenson Verona, New Zealand.

So I am going to close this discussion here and really look for your insight and share your personal strategies.

Please feel free to post your questions or comments and title your post Wealth Building through PPP with Project Creation

Thank you,

Jeff Thomas J L Thomas Consulting

———————————————————————————————————–

Daily Discussions 1

Project Funding: Debt vs. PPP

As all of you know there are many forms of raising funds for your project outside bank lending and other overly creative financing?

Today I am posting two Pros and Cons on Private Equity Funding and PPP from two sources that are completely non-bias but I must add some additional clarity (Defense) to the cons of PPP at the end of this discussion.

Pros and Cons of Private Lending:

PROS:

Private Investors can typically earn over a 15% annualized return on their invested money.

Private lending is typically very secure in 1st lien position on a physical asset such as a property.

If the loan defaults, the lender has the ability to seize the collateral (property) through foreclosure.

Private lending allows an investor to invest funds in real estate without the risks and headaches associated with flipping and renting.

Private lending is typically short term so investor has the ability to move the money in and out if desired.

CONS:

Private lending does not have the same favorable tax advantages that owning does (i.e. mortgage interest deduction, 1031 tax free exchange, etc.)

While private lending does produce tremendous yield (actually better than most cash flowing rental properties), it does not appreciate the way an owned asset does.

Longer term lending can be at risk of inflationary loss.

While this is a relatively high-level analysis, it is important to understand the benefits of one investing method versus the other. In my dealings with investors, it seems like a blended approach works well. I think it is important to own property and get the tax and appreciation benefits that come with it. However, I also like the secure high yield returns that can be obtained from private lending as well. Finding some balance between the two really depends on the goals and risk tolerance of the investor.

Rebuttals: The Cons

Line 2.Scam or Real Trader:

As you read this line and too the sentence where the word (broker) is used. First one needs to know they are working with. Ask if they are a broker? If so one needs to work through the broker chain and access the source that communicates with the trade managers directly such as us. We have a facilitator within our group.

Line 3.Takes Millions to Even Apply:

Bank offered programs below 100M do happen andare typically offered to their existing prime clients first. Any openings that are notfilled are offered to the trade mangers downstream proven sources.These low entry trades that are solicited on the net (Avoid at All Cost) go by such names as Bullet or Turbo just don’t work or at least I have never seen one produce.

We provide all of correct forms and we will poof them before submission through our facilitator that works directly with the trade managers (No Broker Chains) in the correct order as they require.

Other contributing factors to failed trades.

Client has not read what is called (Rules of the Road) or does not adhere.

Client’s paperwork is out order, convoluted or incomplete and the client cannot provide the necessary documents or information. Other wards they are not RWA.

Client cannot pass DD.

There are many other reasons so please feel free to post your questions or comments and title your post as Debt vs. PPP

Thank you,

Jeff Thomas J L Thomas Consulting

Note: Some topics are accquired from other sites

Hi! I know this is kinda off topic but I’d figured I’d

ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa?

My blog addresses a lot of the same subjects as yours and

I feel we could greatly benefit from each other.

If you’re interested feel free to send me an e-mail.

I look forward to hearing from you! Awesome blog by the way!

LikeLike

Hello. Thank you for your kind comment. Please send me your link for review and I will consider a link exchange.

Best regards,

Jeff Thomas

LikeLike